Current Effective 25-Year CDC Rate

6.23%

Current 5-Year TCM Rate

3.75%

How are SBA 504 interest rates determined?

A SBA 504 loan is in fact two loans – a Certified Development Company (CDC) and third party lender loan, each with their own interest rate. The overall loan’s interest rate is somewhere in between the two, determined by the sizes of the loans. For example, if a 504 loan has the typical split of 10% down payment, 40% CDC loan, and 50% third party lender loan, the overall loan interest rate will be a bit closer to the third party lender loan’s rate, as it provides more of the overall loan value.

The CDC loan’s rate is predetermined, based (loosely and indirectly) on treasury security rates (plus fees). The third party lender’s rate is higher and based on a benchmark rate, plus or minus a certain amount.

If the third party lender is interested in the loan, the borrower and lender will negotiate the interest rate based on the strength of the loan, as well as how interested the lender is. At 504Savvy, we work to connect you with the lender most interested in your loan, and thus the lender most likely to give you a favorable rate.

How is the CDC loan’s interest rate determined?

The CDC loan’s rate is determined by the sale of 504 loan debentures, which are collectively marketed and sold to investors every month/every other month (depending on the length of the loan). The rate of the sold debentures becomes the standard CDC loan rate, to which CDC and SBA fees are added to determine the rate of each individual loan. Notably, as the 504 debentures are sold collectively, the CDC parts of all 504 loans funded around the same time have the same rate, with the only rare exception being any difference in CDC fees.

As the CDC loan’s rate can’t be determined until the collective debenture sale – causing a delay of anywhere between 6 weeks and three months – interim financing is usually necessary. This financing, which either comes from the third party lender or a different lender, covers the CDC portion of the loan and allows the full loan to be funded immediately, and therefore the real estate to be purchased, loan to be refinanced, etc.

What are the benchmark rates used for SBA 504 loans?

Third party lender loans use benchmark rates, to which a certain margin is added (or taken away, in rare cases). Common benchmark rates for SBA 504 loans include TCM (Treasury Constant Maturity) rates (with the 5-year, 10-year, and 20-year rates being the most common), the FHLB (Federal Home Loan Banks) rate, and the prime rate.

What role does the benchmark rate play in SBA 504 lending?

A benchmark rate is used to determine the interest rates of third party lender loans. A margin is added to the benchmark rate to determine the loan’s rate, and as such third party lender interest rates can be described as “benchmark rate + #”. For example, if the benchmark rate for a loan was the 5-year TCM rate, the 5-year TCM rate was 4.0%, and a loan’s interest rate was 5-year TCM plus a margin of 3.0%, the interest rate for the loan would be “5-year TCM + 3.0”, or 7.0%. The margin added to the benchmark rate is determined by the quality of the loan, with safer loans getting a lower rate and riskier loans getting a higher rate.

Should I get a fixed or a variable rate loan?

SBA 504 loan rates are usually fully fixed. CDC loan rates are always fixed, while third party lender loan rates are typically fixed. As such, there isn’t much choice for 504 borrowers – however, variable third party lender rates can usually be obtained if the borrower wishes.

Importantly, however, “fixed” 504 third party lender loan rates aren’t fixed at one rate forever. Instead, they’re permanently fixed at their margin above the benchmark rate, with the actual loan rate resetting every five years. For example, if a loan’s rate was fixed at 5-year TCM + 3.0, and at the time of the loan the 5-year TCM was 4.0%, the loan’s rate would be fixed at 7.0% for the first five years. But after five years, if the 5-year TCM rate had gone down 1.0% to 3.0%, the loan’s rate would lower to 6.0% for the next five years, because the loan is still 5-year TCM + 3.0, and as the 5-year TCM rate has lowered 1.0%, so has the loan. This repeats every five years for the life of the loan.

Would every lender give me the same interest rate?

Every CDC will offer the same rate for their loan. For third party lenders, however, the answer is no. Even for the same loan, interest rates can vary from lender to lender. The interest rate a lender offers depends on their assessment of the loan.

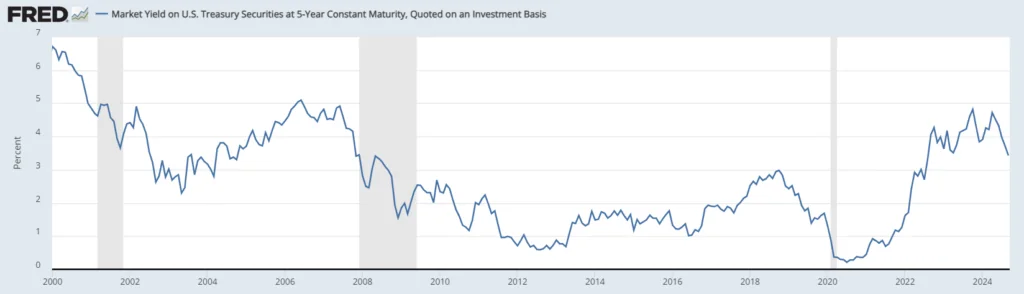

5-Year TCM Rate Recent History

The 5-year TCM rate is near the highest point it has been in recent history. This can seem alarming for borrowers. However, considering the expert consensus that interest rate hikes are at or near their end, the rate seems to be around the highest point it will be for a while.

Additionally, the current high rate environment is not at all unusual, as the 5-year TCM rate has been around or above the current rate multiple times in recent history. What was unusual, however, was the low rate environment that the country was in previously. To have such low rates for so long was unprecedented, and this likely makes any current worries about higher rates worse than they logically should be.

Current higher rate environment make 504 loans a great option. The 5-year TCM rate is higher than it was 5 or 10 years ago, but so are all other interest rates, and this makes the 504 loan’s lower rates an even more attractive feature.